All Categories

Featured

Table of Contents

The drawbacks of unlimited financial are commonly ignored or otherwise mentioned in any way (much of the info available about this idea is from insurance policy agents, which might be a little prejudiced). Just the cash value is expanding at the returns rate. You likewise have to spend for the cost of insurance, fees, and expenditures.

Companies that offer non-direct acknowledgment car loans might have a lower dividend rate. Your cash is secured into a challenging insurance item, and abandonment charges typically do not disappear up until you've had the policy for 10 to 15 years. Every irreversible life insurance policy plan is different, however it's clear somebody's total return on every buck invested in an insurance policy item can not be anywhere close to the dividend price for the policy.

Infinite Income Plan

To give a really standard and theoretical instance, allow's presume somebody has the ability to earn 3%, on average, for each buck they spend on an "boundless banking" insurance policy product (nevertheless costs and charges). This is double the estimated return of whole life insurance policy from Consumer News of 1.5%. If we presume those dollars would certainly be subject to 50% in taxes total otherwise in the insurance coverage product, the tax-adjusted price of return might be 4.5%.

We presume more than ordinary returns overall life product and an extremely high tax rate on bucks not take into the plan (that makes the insurance policy item look far better). The fact for numerous individuals might be worse. This fades in contrast to the lasting return of the S&P 500 of over 10%.

Boundless financial is a wonderful product for agents that offer insurance coverage, yet may not be ideal when compared to the less costly options (with no sales people making fat payments). Right here's a failure of several of the various other supposed benefits of boundless banking and why they might not be all they're gone crazy to be.

How To Start Infinite Banking

At the end of the day you are buying an insurance item. We love the protection that insurance coverage offers, which can be obtained a lot less expensively from an affordable term life insurance coverage policy. Unsettled car loans from the policy may also minimize your death benefit, decreasing another degree of defense in the plan.

The principle only functions when you not only pay the significant costs, however use additional cash to buy paid-up enhancements. The possibility price of every one of those dollars is significant very so when you might instead be buying a Roth IRA, HSA, or 401(k). Even when compared to a taxable financial investment account or even a financial savings account, infinite financial might not use comparable returns (compared to investing) and similar liquidity, access, and low/no cost structure (compared to a high-yield interest-bearing accounts).

With the increase of TikTok as an information-sharing platform, economic advice and approaches have discovered an unique way of spreading. One such method that has actually been making the rounds is the infinite banking principle, or IBC for brief, amassing recommendations from celebrities like rapper Waka Flocka Fire. While the method is currently popular, its roots map back to the 1980s when financial expert Nelson Nash presented it to the world.

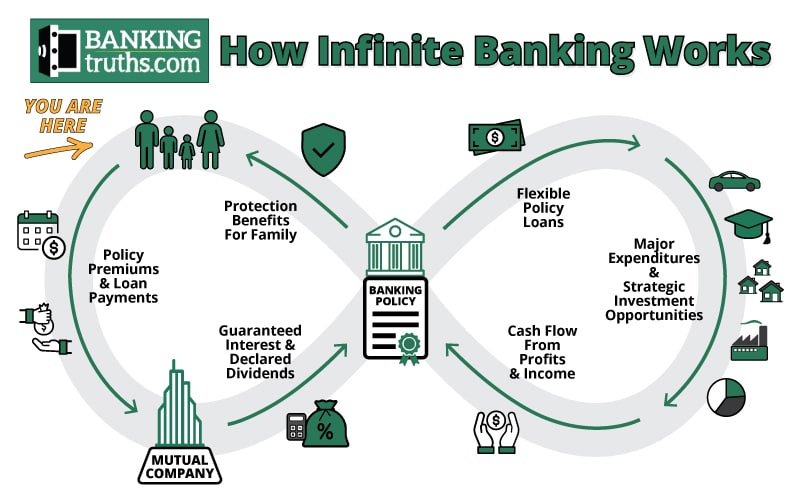

Within these policies, the money worth expands based on a price set by the insurance company. As soon as a substantial money value builds up, policyholders can get a cash money worth car loan. These finances vary from traditional ones, with life insurance policy working as collateral, suggesting one can shed their coverage if borrowing exceedingly without adequate money worth to sustain the insurance costs.

Infinite Banking Concepts

And while the appeal of these plans is apparent, there are natural restrictions and threats, necessitating diligent cash worth tracking. The strategy's authenticity isn't black and white. For high-net-worth people or local business owner, particularly those using methods like company-owned life insurance policy (COLI), the benefits of tax breaks and compound development can be appealing.

The attraction of unlimited financial doesn't negate its difficulties: Price: The foundational requirement, a long-term life insurance policy plan, is more expensive than its term equivalents. Qualification: Not everyone receives whole life insurance due to rigorous underwriting processes that can omit those with details health or lifestyle conditions. Complexity and danger: The elaborate nature of IBC, combined with its threats, may hinder many, specifically when easier and less dangerous choices are readily available.

Allocating around 10% of your month-to-month revenue to the policy is simply not possible for many people. Part of what you review below is just a reiteration of what has actually already been claimed above.

So prior to you get on your own into a situation you're not prepared for, understand the complying with first: Although the principle is typically marketed because of this, you're not really taking a finance from on your own - your own banking system. If that held true, you wouldn't need to repay it. Rather, you're borrowing from the insurance provider and need to settle it with rate of interest

How To Create Your Own Banking System

Some social media messages suggest making use of cash money value from entire life insurance policy to pay for bank card debt. The concept is that when you pay back the loan with rate of interest, the quantity will certainly be sent back to your investments. Sadly, that's not just how it functions. When you repay the funding, a section of that passion goes to the insurance policy company.

For the initial numerous years, you'll be paying off the commission. This makes it exceptionally difficult for your policy to accumulate value throughout this time. Unless you can pay for to pay a few to several hundred dollars for the next years or more, IBC won't work for you.

Not every person should depend exclusively on themselves for economic safety. If you need life insurance policy, right here are some beneficial suggestions to think about: Think about term life insurance policy. These plans give coverage during years with significant financial commitments, like home mortgages, trainee fundings, or when caring for young kids. Make sure to look around for the best rate.

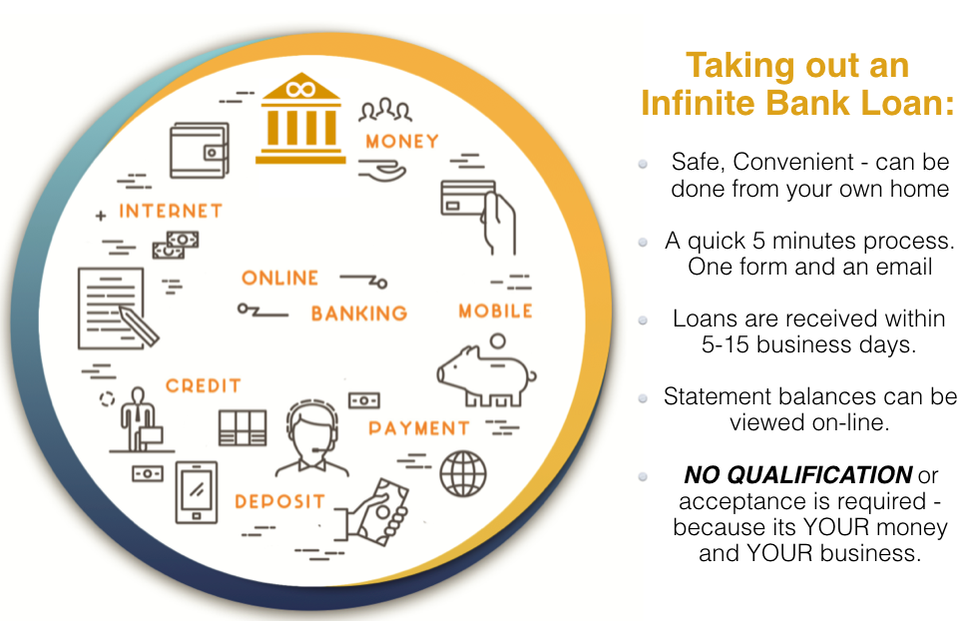

Boundless financial is not a services or product provided by a details establishment. Infinite financial is a method in which you acquire a life insurance policy plan that accumulates interest-earning cash worth and obtain loans against it, "borrowing from on your own" as a resource of capital. After that eventually repay the finance and begin the cycle all over again.

Pay plan premiums, a portion of which constructs cash value. Money worth gains intensifying rate of interest. Take a loan out against the policy's cash worth, tax-free. Pay off car loans with rate of interest. Cash worth accumulates once more, and the cycle repeats. If you use this concept as meant, you're taking money out of your life insurance policy plan to buy everything you would certainly require for the remainder of your life.

Latest Posts

Create Your Own Banking System

Nelson Nash Becoming Your Own Banker Pdf

Whole Life Infinite Banking